Crypto Regulations: A Global Overview

Introduction

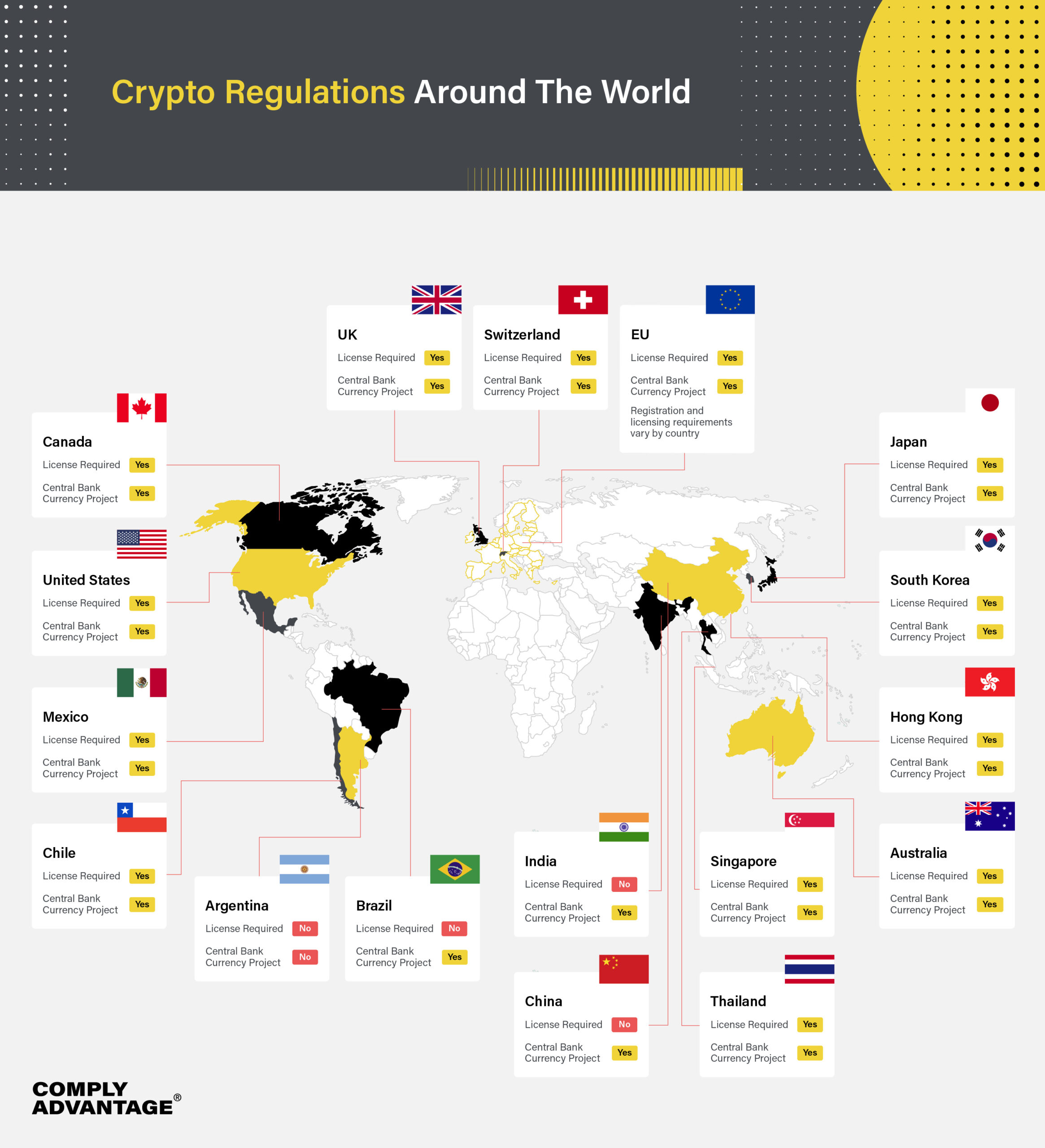

Cryptocurrency, a decentralized digital currency, has gained widespread attention and adoption in recent years. However, its rapid growth has also raised concerns among governments and regulators worldwide. As a result, various countries have implemented different regulations to oversee and control the cryptocurrency industry.

United States

- Securities and Exchange Commission (SEC): Classifies certain cryptocurrencies as securities and regulates them accordingly.

- Commodity Futures Trading Commission (CFTC): Oversees futures and options trading of cryptocurrencies.

- Financial Crimes Enforcement Network (FinCEN): Requires cryptocurrency exchanges to register with them and comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

European Union

- Markets in Crypto-Assets (MiCA): A comprehensive regulatory framework that will come into effect in 2024. It classifies cryptocurrencies and establishes licensing, registration, and AML requirements.

- Fifth Anti-Money Laundering Directive (5AMLD): Requires cryptocurrency exchanges to implement AML and KYC measures.

China

- Banned all cryptocurrency transactions: Cryptocurrency mining, trading, and exchanges are illegal in China.

- Digital Currency Electronic Payment (DCEP): China’s central bank is developing a digital currency that is not based on blockchain technology.

India

- Reserve Bank of India (RBI): Has taken a cautious approach towards cryptocurrencies, prohibiting banks from dealing with cryptocurrency exchanges.

- Cryptocurrency and Regulation of Official Digital Currency Bill, 2021: Under consideration, it seeks to regulate cryptocurrencies while banning private cryptocurrencies and promoting the development of a central bank digital currency.

Japan

- Financial Services Agency (FSA): Regulates cryptocurrency exchanges and requires them to register with the FSA.

- Payment Services Act: Provides a legal framework for cryptocurrency transactions, including exchanges and payments.

South Korea

- Digital Asset Basic Act: Regulates cryptocurrency exchanges and requires them to implement security measures and AML protocols.

- Special Financial Transactions Information Act: Requires cryptocurrency exchanges to report suspicious transactions to the Financial Intelligence Unit.

Other Countries

- El Salvador: Has adopted Bitcoin as legal tender.

- Ukraine: Has legalized cryptocurrency but banned the use of Russian exchanges.

- United Kingdom: Has implemented AML and KYC regulations for cryptocurrency exchanges.

- Australia: Regulates cryptocurrency exchanges and requires them to comply with AML and KYC requirements.

- Canada: Has taken a measured approach towards regulation, focusing on consumer protection and financial stability.

Conclusion

The regulatory landscape for cryptocurrency is constantly evolving as governments seek to balance innovation with risk management. While some countries have taken a strict approach, others have adopted more flexible regulations to encourage responsible adoption. As the cryptocurrency industry matures, it is likely that regulations will continue to be refined and harmonized across jurisdictions.