SMS Fraud: Safeguarding Your Bank Account with Login Security Questions

In today’s digital world, SMS (Short Message Service) has become an essential part of our communication, extending its utility even to the banking sector. However, with convenience comes risk, and SMS fraud is a growing concern that can lead to unauthorized access to bank accounts and financial losses.

What is SMS Fraud?

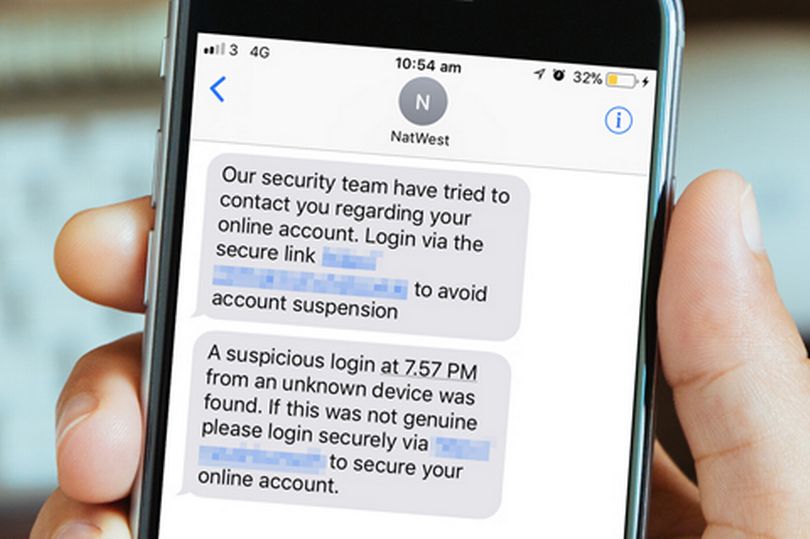

SMS fraud, also known as smishing, involves criminals sending fraudulent text messages that appear to come from legitimate sources, such as banks or financial institutions. These messages typically contain links or instructions that, if clicked or followed, can lead to the compromise of your bank account login credentials or security question verification.

How SMS Fraud Works

SMS fraud often starts with a text message that appears to be from your bank. The message may claim to be confirming a recent transaction, notifying you about suspicious activity, or asking you to verify your account information. The message may contain a link that, when clicked, redirects you to a fake website that looks identical to your bank’s genuine website.

Once you are on the fake website, you may be prompted to enter your login credentials, such as your username and password. You may also be asked to answer security questions to further authenticate your identity. The criminals behind this scheme collect your login information and use it to gain unauthorized access to your bank account.

Protecting Yourself from SMS Fraud

To safeguard your bank account from SMS fraud, it is crucial to remain vigilant and take the following precautions:

- Be cautious of suspicious text messages: If you receive an SMS from your bank that you were not expecting or that contains alarming information, do not click on any links or provide any personal information. Contact your bank via a trusted channel to verify the message’s legitimacy.

- Never share your login credentials via text message: Your bank will never ask you to share your username, password, or security question answers via SMS. If you receive such a message, it is a red flag of fraud.

- Verify website addresses carefully: When accessing your bank’s website, ensure that you are visiting the genuine site. Check for any misspellings or irregularities in the domain name or URL.

- Use strong passwords and security questions: Set complex, unique passwords for all your financial accounts and use strong security questions that are not easily guessable.

- Enable two-factor authentication: Consider enabling two-factor authentication for your bank account. This adds an extra layer of security, requiring you to provide a verification code sent to your phone number or email address before logging in.

What to Do if You Fall Victim to SMS Fraud

If you suspect you have fallen victim to SMS fraud, take immediate action to protect your account:

- Contact your bank: Notify your bank immediately and inform them that your account may have been compromised. They can freeze your account and investigate the incident.

- Change your passwords: Change your bank account password and any other accounts that may have been compromised.

- Monitor your account activity: Keep a close eye on your bank account statements for any unauthorized transactions. Report any suspicious activity to your bank promptly.

By following these precautions, you can significantly reduce your risk of becoming a victim of SMS fraud and protect your bank account from unauthorized access. Remember, banks will never ask for sensitive information such as your login credentials via text message, and any such requests should be treated with suspicion.