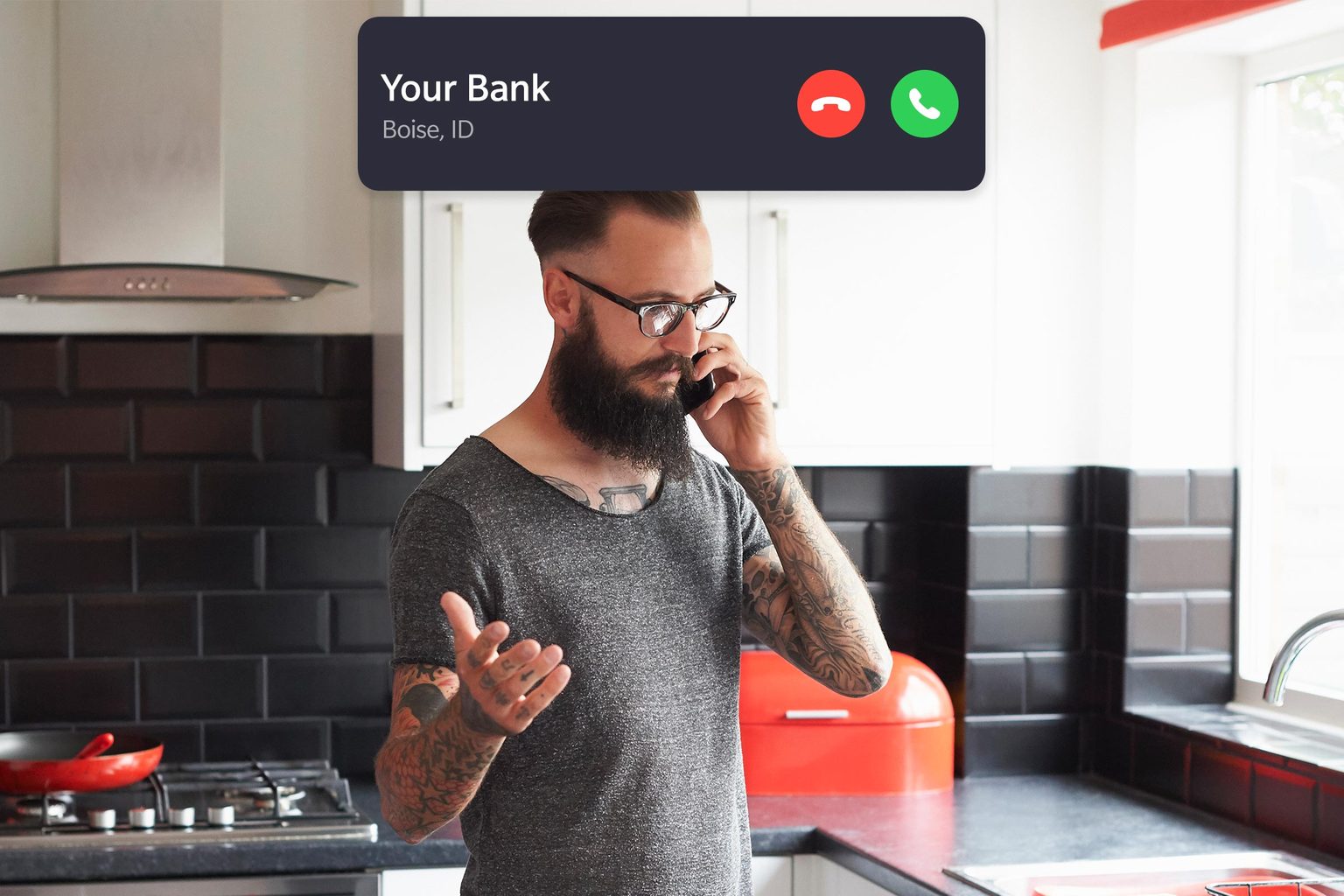

Phone Call Scam: Posing as Bank Account Manager

In recent times, consumers have been targeted by a sophisticated phone call scam that involves fraudsters posing as bank account managers. These scammers use various tactics to trick victims into divulging sensitive information or transferring funds to fraudulent accounts.

Modus Operandi:

-

Contact and Impersonation: The scammer initiates contact via phone call, typically displaying a caller ID that resembles a legitimate bank number. They introduce themselves as an account manager and express concern regarding suspicious activity or irregularities on the victim’s account.

-

Urgency and Panic: The caller creates a sense of urgency, claiming that immediate action is necessary to prevent account compromise or fraudulent transactions. They use alarmist language and pressure tactics to instill fear in the victim.

-

Verification Request: The scammer attempts to verify the victim’s identity by asking for personal information such as their full name, account number, and PIN. They may also request access to the victim’s computer or online banking credentials.

-

Remote Access: Once the victim provides access, the scammer may attempt to transfer funds or make unauthorized transactions from the victim’s account. They may use malware or phishing techniques to gain control of the victim’s computer or online banking session.

-

Account Closure and New Account Creation: In some cases, the scammer may convince the victim to close their existing bank account and transfer their funds to a new account, which is actually controlled by the scammer.

Red Flags:

-

Unsolicited Contact: Legitimate bank representatives rarely initiate contact with customers via phone calls.

-

Pressure Tactics: Scammers often create a sense of urgency to prevent victims from thinking critically about the situation.

-

Request for Sensitive Information: Banks should never ask for PINs, passwords, or other sensitive financial information over the phone.

-

Remote Access Attempts: Never grant remote access to anyone claiming to be from your bank.

Preventive Measures:

-

Verify Caller Identity: Contact your bank directly using the official phone number listed on their website or bank statement.

-

Protect Personal Information: Never share PINs, passwords, or other sensitive information over the phone.

-

Avoid Remote Access: Do not grant remote access to anyone claiming to be from your bank.

-

Be Aware of Scams: Stay informed about current phone call scams to recognize and avoid them.

-

Report Suspicious Activity: If you receive a suspicious phone call, report it to your bank and relevant authorities immediately.

Stay Vigilant:

Phone call scams continue to evolve and become more sophisticated. By being aware of the tactics used by scammers and taking preventive measures, you can protect yourself from becoming a victim of this malicious scheme.