Email Phishing for Bank Account Password Recovery

Introduction

Email phishing is a common form of cyberattack where criminals use emails to trick victims into revealing sensitive information, such as bank account passwords. These attacks can have devastating financial consequences, as they allow criminals to access and steal funds from victims’ accounts.

How Does Email Phishing Work?

Phishing emails often appear to come from legitimate sources, such as banks or other financial institutions. They typically contain links that direct victims to fake websites that resemble the real websites of the targeted organizations. Victims who enter their credentials on these fake websites unknowingly give them to the criminals.

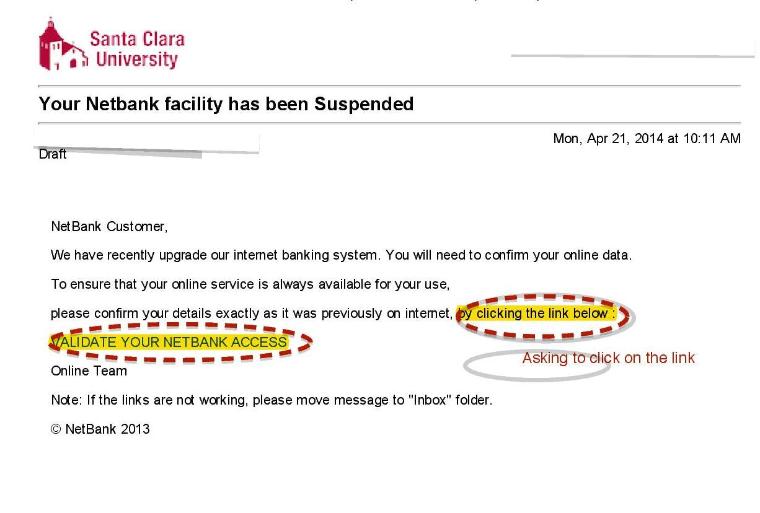

Specific Attack Technique: Password Recovery Emails

One common phishing technique involves emails that claim to be password recovery notifications from banks. These emails typically state that the victim’s account has been temporarily locked or suspended due to suspicious activity. To unlock the account, the victim is instructed to follow a link and enter their login credentials.

Warning Signs of Phishing Emails

There are several warning signs that can indicate an email is a phishing attempt:

- Suspicious sender address: The email address of the sender may not match the legitimate sender.

- Generic greetings: The email may use generic greetings, such as "Dear Customer" or "Valued Member," instead of using the victim’s name.

- Urgent tone: The email may use urgent or threatening language to create a sense of urgency and pressure the victim to respond.

- Typos and grammatical errors: Phishing emails often contain typos and grammatical errors.

- Suspicious links: The links in the email may point to fake websites that use suspicious domain names or have URL structures that do not match the legitimate websites.

Consequences of Phishing Attacks

If a victim falls for a phishing attack, the consequences can be severe:

- Loss of funds: Criminals can use the stolen password to access the victim’s bank account and withdraw funds.

- Identity theft: Phishing emails can also be used to collect other sensitive information, such as social security numbers and addresses, which can be used for identity theft.

- Damage to reputation: Banks and other financial institutions may freeze or close accounts that have been compromised by phishing attacks, which can damage the victim’s financial standing and reputation.

Prevention Tips

To protect yourself from email phishing attacks, follow these tips:

- Be cautious of suspicious emails: Never click on links or open attachments in emails from unknown senders.

- Verify sender addresses: Check the email address of the sender carefully to ensure it matches the legitimate sender.

- Hover over links: Hover your mouse over links in emails to see the actual destination URL before clicking.

- Use strong passwords: Create strong and unique passwords for your bank accounts and other financial accounts.

- Enable two-factor authentication: Use two-factor authentication for your bank accounts to add an extra layer of security.

- Report phishing attempts: If you receive a suspicious email, report it to the organization that is being impersonated and to your email provider.

Conclusion

Email phishing is a serious threat to bank account security. By understanding how phishing attacks work and recognizing the warning signs, you can protect yourself from these scams and keep your financial information safe.