SMS Fraud for Credit Card Account Security Code Change Confirmation

Introduction

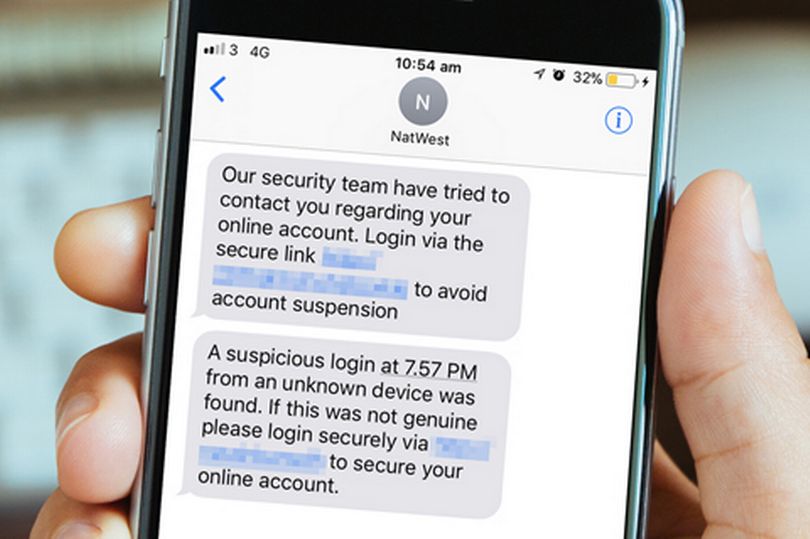

SMS fraud is a growing problem that can lead to identity theft and financial loss. In this type of fraud, criminals use text messages to trick victims into giving up their personal information, such as their credit card account security code. This information can then be used to make unauthorized purchases or to access the victim’s financial accounts.

How SMS Fraud Works

SMS fraud typically begins with a text message from a number that appears to be legitimate. The message may look like it is from your bank or credit card company and may state that you need to update your account security code. The message will then include a link to a website where you are prompted to enter your security code.

If you click on the link and enter your security code, the criminals will be able to access your credit card account and make unauthorized purchases. They may also be able to access your other financial accounts, such as your checking account or savings account.

How to Protect Yourself from SMS Fraud

There are several things you can do to protect yourself from SMS fraud:

- Never click on links in text messages from unknown numbers. If you receive a text message from a number that you do not recognize, delete it immediately. Do not open any links or attachments in the message.

- Be wary of text messages that claim to be from your bank or credit card company. If you receive a text message from your bank or credit card company, do not click on any links in the message. Instead, call the bank or credit card company directly to verify the message.

- Use strong security codes. Your credit card account security code is a four-digit number that is used to verify your identity when you make purchases online or over the phone. Make sure that your security code is strong and that it is not easy to guess.

- Monitor your credit card statements regularly. Regularly review your credit card statements for any unauthorized purchases. If you see any unauthorized purchases, report them to your credit card company immediately.

What to Do if You Are a Victim of SMS Fraud

If you believe that you have been a victim of SMS fraud, there are several things you should do:

- Contact your credit card company immediately. Report the fraud to your credit card company and ask them to freeze your account.

- Contact your bank. If you have given the criminals your bank account information, contact your bank and ask them to freeze your account.

- File a police report. You should also file a police report about the fraud. This will help to create a record of the incident and may help to catch the criminals.

Conclusion

SMS fraud is a serious problem that can lead to identity theft and financial loss. By following these tips, you can protect yourself from this type of fraud.