Bitcoin Halving Expected to Significantly Impact Price and Mining Profitability

Introduction

Bitcoin, the world’s leading cryptocurrency, is set to undergo its third halving event on May 12, 2020. This highly anticipated event is expected to have significant implications for the coin’s price and mining profitability.

What is Bitcoin Halving?

Bitcoin halving is an event that occurs approximately every four years, in which the block reward given to miners for verifying transactions is reduced by half. This is part of Bitcoin’s intrinsic design and serves to control the issuance and inflation of the cryptocurrency.

Impact on Price

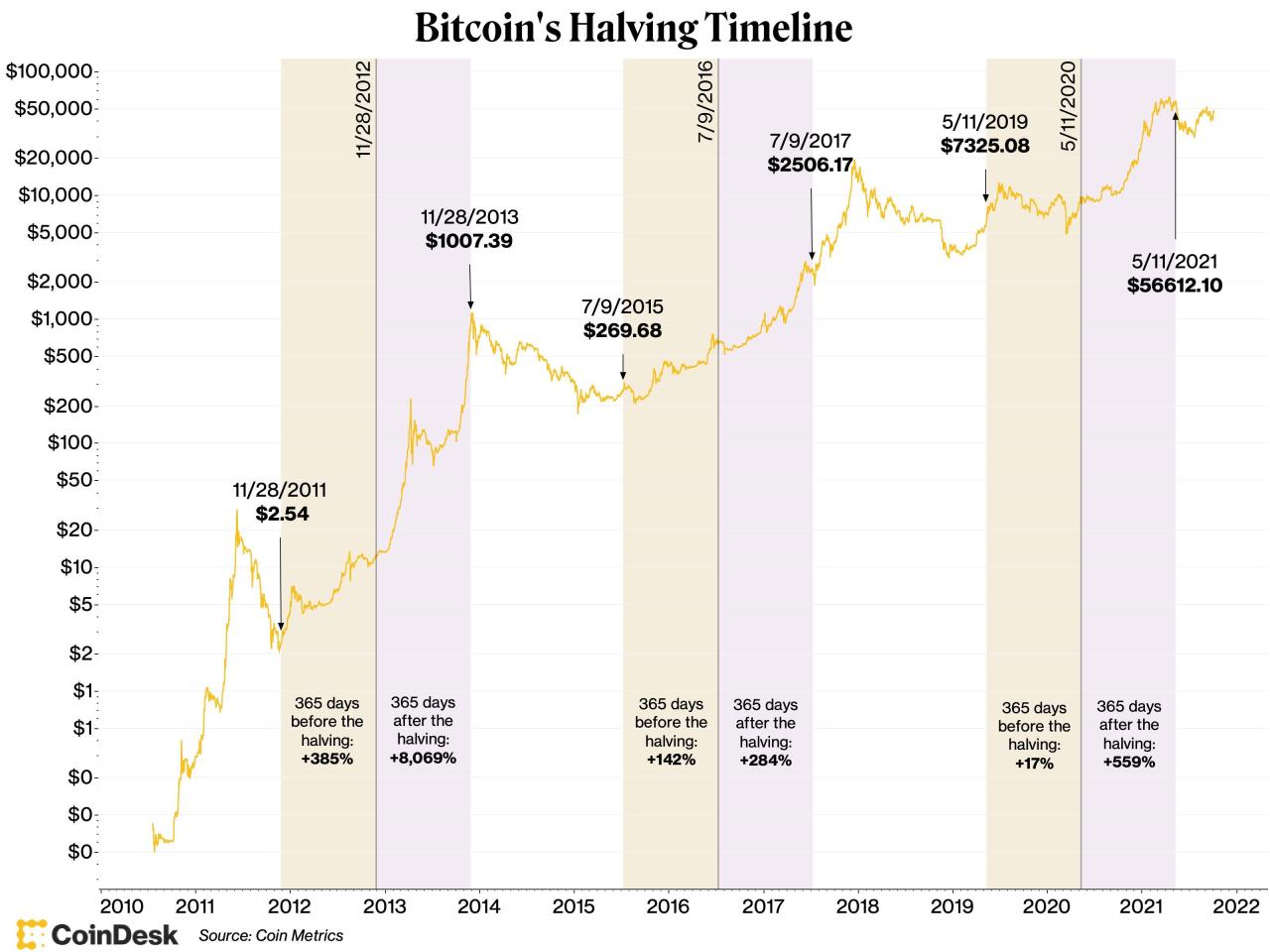

Historically, Bitcoin halvings have been associated with substantial price increases. This is primarily due to the reduced supply of new coins entering the market, which creates a higher demand for existing coins.

Analysts anticipate a similar surge in price following the upcoming halving. Some predict that the value of Bitcoin could reach new highs, potentially surpassing its previous all-time high of $20,000.

Impact on Mining Profitability

The halving will also have a profound impact on mining profitability. With the block reward decreasing by half, miners will receive less Bitcoin for their efforts. This will make it less profitable to mine Bitcoin, especially for those with older and less efficient mining equipment.

As a result, some miners may choose to sell their equipment or switch to mining other cryptocurrencies. This could lead to a decrease in the overall hash rate of the Bitcoin network, which may result in longer transaction times.

Long-Term Implications

The halving event is a significant milestone in Bitcoin’s development. It underscores the coin’s finite supply and reinforces its role as a store of value. Moreover, it highlights the decentralized and immutable nature of the Bitcoin network, as the halving is enforced by the network’s code and is not subject to external manipulation.

Conclusion

The upcoming Bitcoin halving is a highly anticipated event that is expected to have a significant impact on the cryptocurrency’s price and mining profitability. While price predictions are subject to market volatility, the event has historically been associated with price surges. Additionally, the halving will challenge the profitability of mining and may lead to a decrease in the network’s hash rate. Ultimately, the halving serves as a reminder of Bitcoin’s finite supply and its long-term potential as a digital asset.