Email Phishing for Bank Account Recovery

Introduction

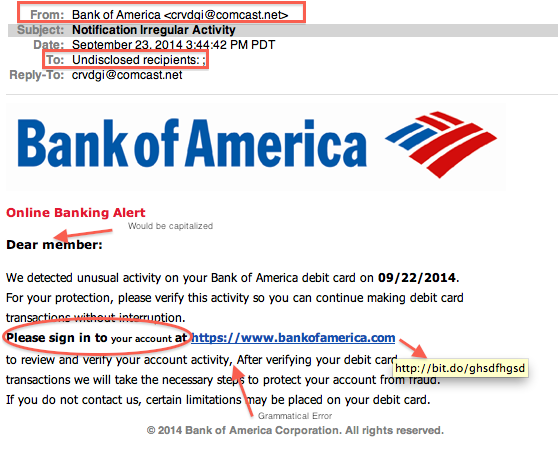

Email phishing is a form of cybercrime in which criminals attempt to obtain sensitive information, such as passwords, credit card numbers, and bank account details, by using disguised emails that appear to come from legitimate sources. This article explores the tactics employed by phishers in targeting bank account recovery.

Phishing Tactics

Phishing emails targeting bank account recovery often employ the following tactics:

- Spoofing: Emails are designed to look like they originate from official bank or financial institutions. They may use similar logos, fonts, and email addresses.

- Urgent Tone: Emails create a sense of urgency by claiming the victim’s account has been compromised or requires immediate action.

- Embedded Links: Emails contain links that lead to fraudulent websites designed to collect sensitive information.

- Personalization: Emails may include the victim’s name or account details to appear more legitimate.

- Social Engineering: Phishers use social engineering techniques, such as psychological manipulation, to trick victims into clicking links or providing information.

How Phishers Exploit Bank Account Recovery

Phishers target bank account recovery processes by sending emails that:

- Claim Account Lockouts: They claim the victim’s account has been locked due to security concerns.

- Request Personal Details: Emails ask the victim to verify their identity by providing sensitive information, such as account numbers, PINs, or passwords.

- Send Verification Codes: Phishers may send verification codes to the victim’s phone or email, which they can use to gain access to the account if it is compromised.

- Provide "Account Reset" Links: Emails contain links that redirect to fraudulent websites where victims are asked to reset their passwords and provide additional information.

Consequences of Email Phishing

Falling victim to email phishing for bank account recovery can have severe consequences, including:

- Account Compromise: Phishers can gain access to the victim’s bank account and steal funds.

- Identity Theft: Sensitive information provided by the victim can be used for identity theft purposes.

- Financial Loss: Victims may lose significant amounts of money due to fraudulent transactions or account takeovers.

- Damage to Reputation: Banks and financial institutions may face reputational damage if customers fall victim to phishing scams.

Prevention and Mitigation

To prevent and mitigate email phishing for bank account recovery, individuals should:

- Be cautious of unsolicited emails: Do not click on links or open attachments from unknown senders.

- Verify sender legitimacy: Check the email address and website of the purported financial institution.

- Never provide sensitive information: Banks or financial institutions will never ask for sensitive information via email.

- Report phishing attempts: Forward suspicious emails to the relevant authorities or the bank’s security department.

- Use strong passwords: Use complex, unique passwords for all banking and financial accounts.

- Enable two-factor authentication: Use additional layers of security, such as SMS or app-based authentication, to protect accounts.

Conclusion

Email phishing is a serious threat to the security of bank accounts. By understanding the tactics employed by phishers and implementing preventive measures, individuals can protect themselves against these scams and safeguard their financial information. Banks and financial institutions should invest in robust security measures and educate their customers about phishing threats. By working together, we can combat email phishing and protect the integrity of our financial systems.