Beware of Email Scam Posing as Financial Institution Verification

Introduction

Cybercriminals are constantly devising new ways to trick innocent victims into falling for their scams. One common tactic involves sending emails that appear to come from legitimate financial institutions, such as banks or credit unions. These emails often claim that your account has been compromised or that you need to verify your information. If you click on the links or provide the requested information, you could be putting your personal and financial data at risk.

How the Scam Works

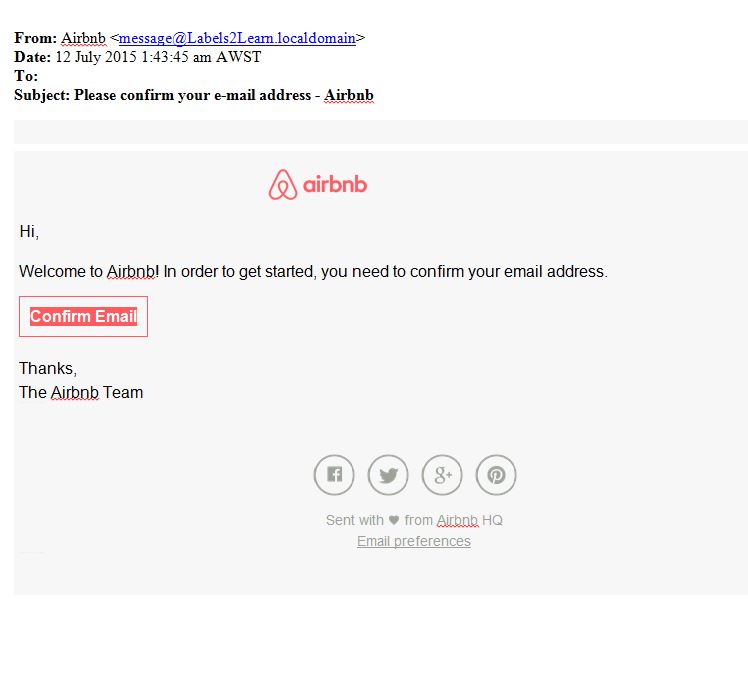

The scam typically begins with an email that looks very similar to an official communication from a financial institution. The email may have the institution’s logo, colors, and other branding elements. It may also contain your name, account number, or other personal information to make it appear more legitimate.

The email will likely claim that your account has been compromised or that there has been suspicious activity on your account. It may also state that you need to verify your information to prevent your account from being locked or frozen.

The email will then provide a link to a fake website that looks identical to the legitimate website of the financial institution. If you click on the link, you will be taken to a page where you are prompted to enter your login credentials, personal information, or financial data.

How to Avoid the Scam

There are a few things you can do to avoid falling for this scam:

- Never click on links in emails from financial institutions. If you receive an email from your bank or credit union, do not click on any links in the email. Instead, go to the institution’s website directly by typing the address into your browser.

- Never provide your personal or financial information in response to an email. Financial institutions will never ask you to provide your login credentials, personal information, or financial data via email.

- Be suspicious of emails that create a sense of urgency. Scammers often use language that creates a sense of urgency to trick you into clicking on a link or providing your information. If you receive an email that says your account will be locked or frozen if you do not take immediate action, it is likely a scam.

What to Do If You’ve Been Scammed

If you have fallen for this scam, you should take the following steps:

- Contact your financial institution immediately. Report the scam to your bank or credit union and let them know that you have provided your personal or financial information to a scammer.

- Freeze your credit. Contact the major credit bureaus (Equifax, Experian, and TransUnion) and freeze your credit to prevent the scammer from opening new accounts in your name.

- File a police report. You can file a police report about the scam with your local police department.

- Monitor your credit reports. Regularly monitor your credit reports for any unauthorized activity.

Conclusion

Email scams posing as financial institution verification are becoming increasingly common. By following the tips in this article, you can help protect yourself from these scams. Remember, never click on links in emails from financial institutions, never provide your personal or financial information in response to an email, and be suspicious of emails that create a sense of urgency.