Microsoft Excel: Effective Budgeting and Planning

Microsoft Excel is a powerful tool that can be used for a variety of budgeting and planning tasks. Whether you’re an individual trying to manage your personal finances or a business owner creating a budget for your company, Excel can help you stay organized and make informed decisions.

Features of Microsoft Excel for Budgeting and Planning

Excel offers a number of features that make it ideal for budgeting and planning tasks, including:

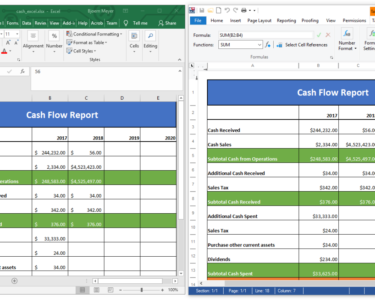

- Spreadsheets: Excel’s spreadsheets allow you to create tables of data that can be easily sorted, filtered, and analyzed. This makes it easy to track your income and expenses, create budgets, and forecast future financial performance.

- Formulas: Excel’s formulas allow you to perform calculations on your data. This can be helpful for tasks such as calculating your total income or expenses, determining your net worth, or creating a budget.

- Charts and graphs: Excel’s charts and graphs can help you visualize your data and identify trends. This can be useful for understanding your financial situation and making informed decisions about your budget.

Creating a Budget in Excel

To create a budget in Excel, you’ll need to follow these steps:

- Create a spreadsheet. The first step is to create a spreadsheet that will contain your budget. You can use the default spreadsheet template or create your own custom template.

- Enter your income and expenses. Once you’ve created your spreadsheet, you’ll need to enter your income and expenses. Be sure to include all of your income sources and expenses, both fixed and variable.

- Create a budget. Once you’ve entered your income and expenses, you can create a budget. A budget is simply a plan for how you’re going to spend your money. You can create a budget by assigning each of your income sources to a specific category of expenses.

- Track your progress. Once you’ve created a budget, you’ll need to track your progress. This will help you stay on track and make adjustments as needed. You can track your progress by comparing your actual income and expenses to your budgeted amounts.

Planning in Excel

Excel can also be used for a variety of planning tasks, including:

- Scenario planning: Scenario planning is a process of creating different scenarios to explore possible outcomes. Excel can be used to create scenario plans by creating different spreadsheets for each scenario.

- Financial forecasting: Financial forecasting is the process of predicting future financial performance. Excel can be used to create financial forecasts by using historical data to create models that predict future performance.

- Project planning: Project planning is the process of creating a plan for a project. Excel can be used to create project plans by creating spreadsheets that track tasks, timelines, and resources.

Conclusion

Microsoft Excel is a powerful tool that can be used for a variety of budgeting and planning tasks. By using Excel, you can stay organized, make informed decisions, and achieve your financial goals.