SMS Fraud: Bank Account Closure Confirmation

Introduction:

SMS fraud, involving unsolicited text messages, has become increasingly prevalent. One deceptive tactic utilized by fraudsters is using SMS to confirm bank account closure.

Modus Operandi:

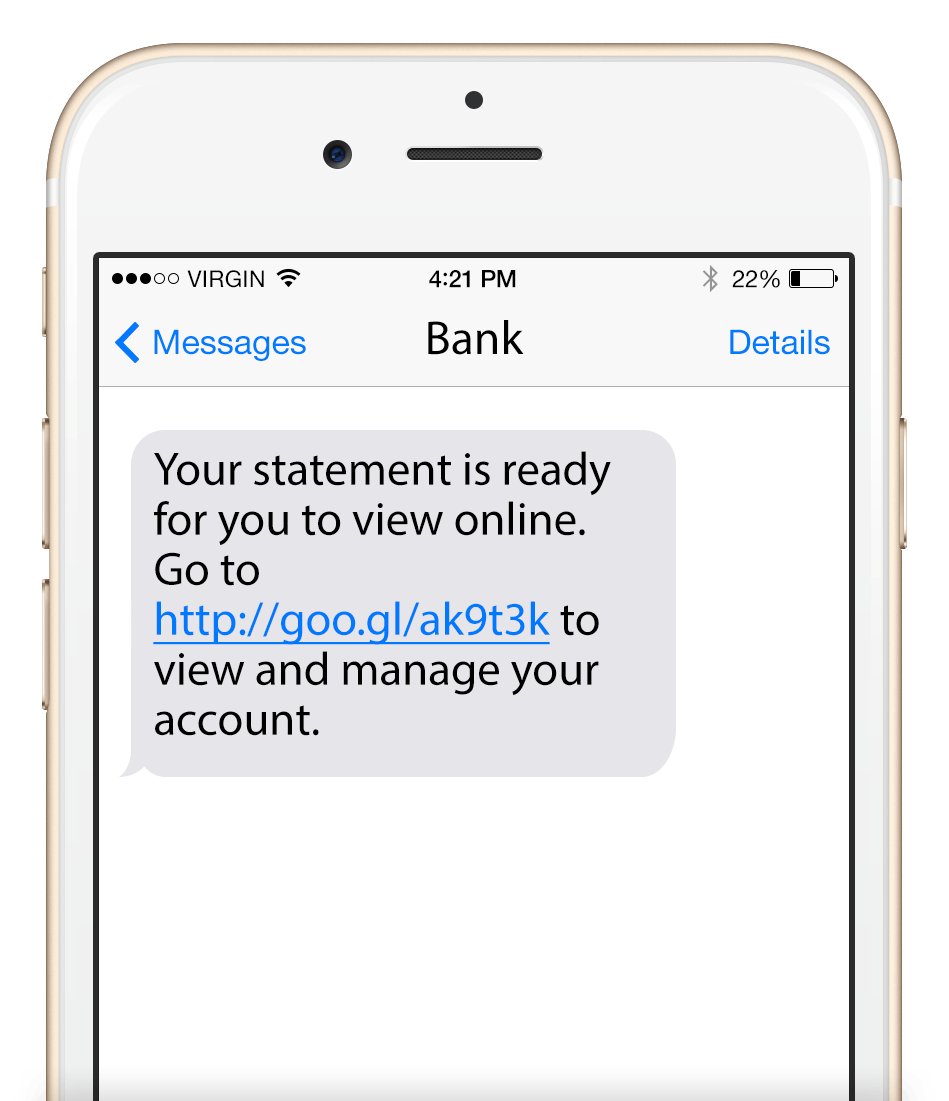

Fraudsters impersonate bank employees and send SMS messages to unsuspecting victims, claiming that their bank accounts will be closed due to security concerns or inactivity. These messages typically include a link or a phone number for verification.

Consequences:

Clicking on the link or calling the provided number exposes victims to phishing scams. Fraudsters can harvest personal and financial information, such as account numbers, PINs, and passwords. This compromised information can lead to unauthorized account access, financial losses, and identity theft.

Warning Signs:

- Unsolicited messages: Be suspicious of any SMS messages from unknown senders, claiming to be from your bank.

- Sense of urgency: Fraudsters often create a sense of panic to pressure victims into acting quickly.

- Suspicious links and phone numbers: Do not click on links or call phone numbers provided in unsolicited SMS messages.

- Request for personal information: Genuine banks will never request sensitive information via SMS.

How to Protect Yourself:

- Ignore unsolicited messages: Do not respond to or engage with suspicious SMS messages.

- Verify with your bank directly: Contact your bank using the official phone number or website to verify the authenticity of any account closure notifications.

- Report suspicious activity: If you receive a suspicious SMS message, report it to your bank and the relevant authorities.

- Enable two-factor authentication: Implement additional security measures by enabling two-factor authentication for your bank account.

Conclusion:

SMS fraud for bank account closure confirmation is a growing threat that can result in severe financial consequences. By recognizing the warning signs and taking precautionary measures, you can protect yourself from falling victim to these deceptive tactics. Remember to always verify information directly with your bank to ensure your account security.