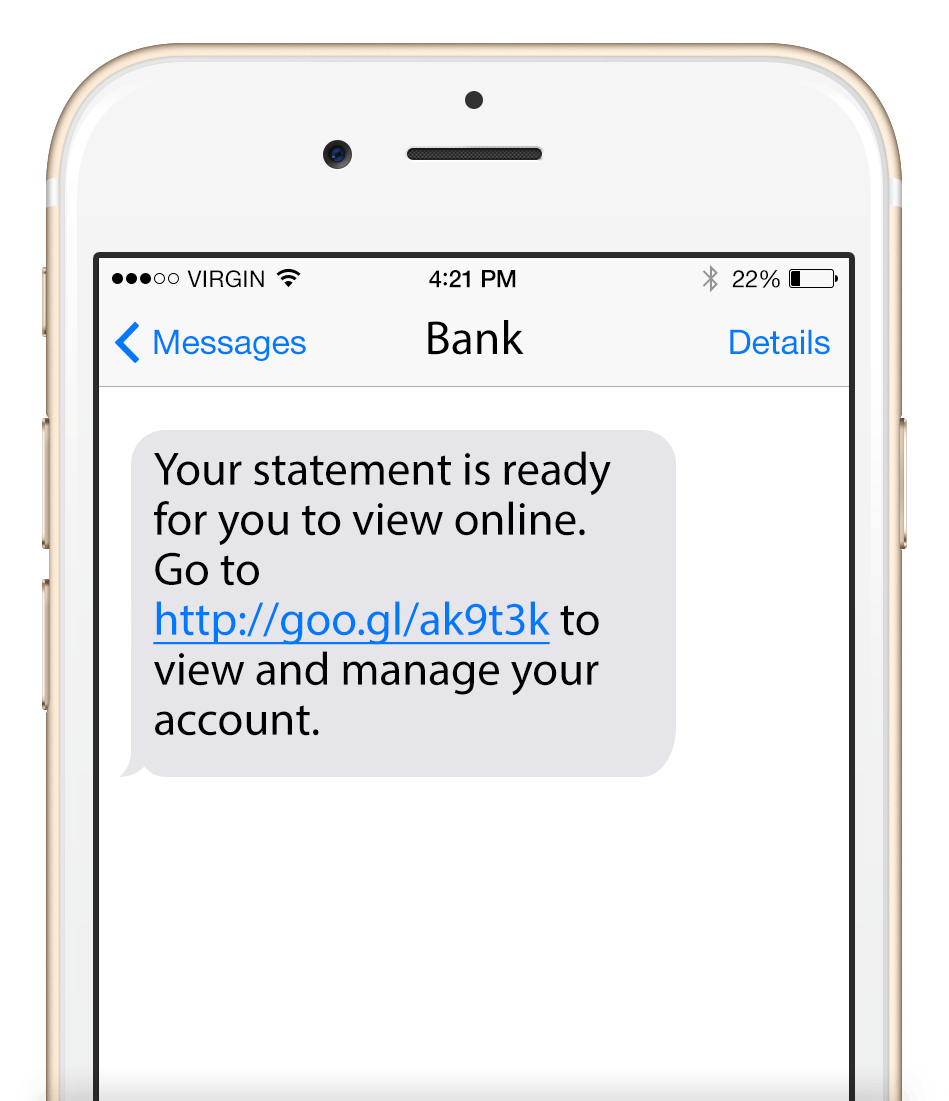

SMS Fraud for Bank Account Closure Verification

In the era of digital banking, fraudsters are constantly finding new ways to target unsuspecting victims. One such scam is SMS fraud, where fraudsters send text messages to victims impersonating banks or other financial institutions. These messages often contain malicious links that trick victims into providing their personal and financial information.

How the Scam Works

SMS fraud messages typically follow a specific pattern:

- Phishing Links: The message contains a link that appears to be from a legitimate bank website. Clicking on this link takes victims to a fake website designed to steal their login credentials.

- Closure Verification: The message claims that your bank account is being closed or suspended due to suspicious activity. It asks you to verify your account by clicking on the link provided.

- Urgent Request: The message creates a sense of urgency by stating that you need to act immediately to prevent your account from being closed. It may also threaten to freeze your funds.

Consequences of Falling for the Scam

If you fall for this scam, you risk providing fraudsters with sensitive information such as:

- Bank account number

- PIN

- OTP (One Time Password)

- Personal details (name, address, date of birth)

This information can be used by fraudsters to drain your bank account, make fraudulent transactions, or steal your identity.

Protecting Yourself

To protect yourself from SMS fraud, follow these guidelines:

- Never click on suspicious links: If you receive a text message from a bank or financial institution, do not click on any links within the message.

- Contact your bank directly: If you have any concerns about your bank account, contact your bank directly using the official phone number or website listed on your bank statement.

- Be cautious of urgent requests: Fraudsters often create a sense of urgency to pressure victims into acting quickly. Be wary of messages that ask you to act immediately or face consequences.

- Use strong passwords: Use strong and unique passwords for all your online accounts, including your bank account.

- Enable two-factor authentication: If available, enable two-factor authentication (2FA) on your bank account and other sensitive accounts. This adds an extra layer of security by requiring a code sent to your phone or email for every login attempt.

Remember, banks and financial institutions will never ask for your personal or financial information via SMS. If you receive a suspicious SMS message, do not respond and report it to your bank immediately. By staying vigilant and following these safety measures, you can help protect your bank account from fraud.