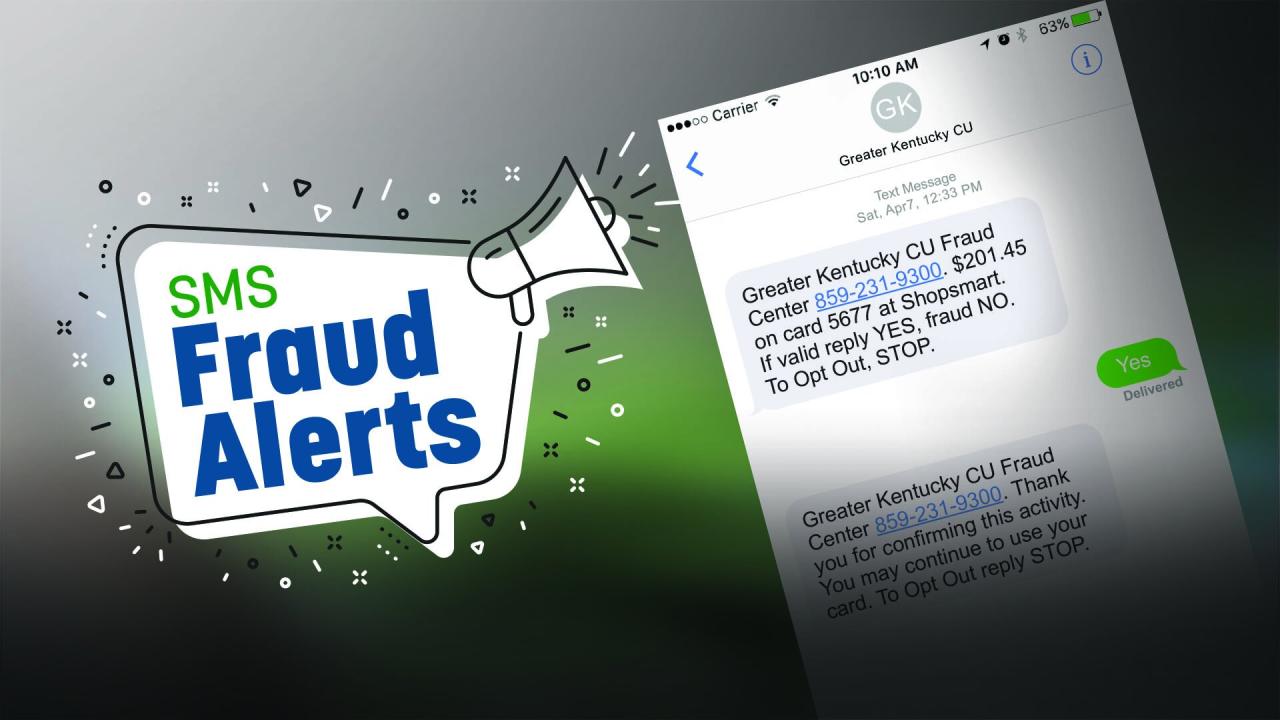

SMS Fraud on the Rise for Credit Card Purchase Confirmations

In recent years, SMS fraud has emerged as a growing concern for financial institutions and consumers alike. SMS fraud involves the use of text messages to trick victims into providing sensitive information, such as their credit card details or login credentials.

One common type of SMS fraud is credit card purchase confirmation scams. In these scams, fraudsters send text messages that appear to come from legitimate businesses, such as banks or credit card companies. The messages typically state that a recent purchase has been made on the victim’s credit card and provide a link to confirm the transaction.

When the victim clicks on the link, they are taken to a fake website that looks like the real website of the financial institution. On the fake website, the victim is prompted to enter their credit card details or login credentials. Once the victim provides this information, the fraudsters can use it to make unauthorized purchases or access the victim’s financial accounts.

SMS fraud can be difficult to detect, as the messages often appear to come from legitimate sources. However, there are a few red flags that consumers should be aware of:

- The message contains a link to a website that you do not recognize.

- The message states that a recent purchase has been made on your credit card, but you do not recognize the purchase.

- The message asks you to provide your credit card details or login credentials.

If you receive a text message that you believe may be fraudulent, do not click on the link. Instead, contact your financial institution directly to verify the transaction.

Financial institutions are also taking steps to combat SMS fraud. Many banks and credit card companies now offer two-factor authentication for online transactions, which requires customers to enter a code that is sent to their mobile phone in addition to their password. This makes it more difficult for fraudsters to access customers’ accounts, even if they have obtained their passwords.

Consumers can also take steps to protect themselves from SMS fraud:

- Be aware of the red flags of SMS fraud, such as messages that contain links to unknown websites or ask for sensitive information.

- Do not click on links in text messages from unknown senders.

- If you receive a text message from your financial institution about a recent purchase, contact the institution directly to verify the transaction.

- Keep your software up to date and use a firewall to protect your computer from malware that can steal your personal information.

By following these tips, consumers can help to protect themselves from SMS fraud and keep their financial information safe.