Microsoft Excel: Exploring Financial Functions

Microsoft Excel is a powerful spreadsheet application that offers a wide range of financial functions to help users analyze and manage financial data. These functions allow users to perform complex calculations quickly and easily, saving time and reducing the risk of errors.

Types of Financial Functions

Excel offers a variety of financial functions that fall into several categories, including:

- Loan and mortgage functions: Calculate payments, interest, and other values related to loans and mortgages.

- Cash flow functions: Determine the present value, future value, and internal rate of return of cash flows.

- Statistical functions: Calculate financial ratios and other statistical measures to analyze financial performance.

- Date and time functions: Manipulate dates and times to calculate future values, payment schedules, and other time-sensitive data.

Common Financial Functions

Below are some of the most commonly used financial functions in Excel:

- PV: Calculates the present value of a series of cash flows.

- FV: Calculates the future value of a series of cash flows.

- IRR: Calculates the internal rate of return of a series of cash flows.

- PMT: Calculates the periodic payment for a loan or mortgage.

- NPER: Calculates the number of periods for a loan or mortgage.

Using Financial Functions

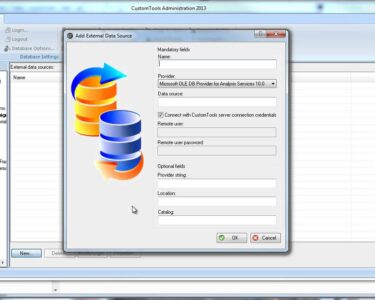

To use a financial function in Excel, follow these steps:

- Click the "Insert" tab.

- Click the "Financial" function group.

- Select the desired function from the dropdown menu.

- Enter the required arguments, such as interest rate, payment amount, and number of periods.

- Click "OK" to calculate the result.

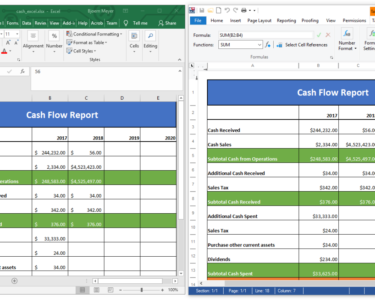

Example

Let’s calculate the monthly payment for a 30-year mortgage of $200,000 with an interest rate of 4%.

- Click the "Insert" tab.

- Click the "Financial" function group.

- Select the "PMT" function.

- Enter the following arguments:

- Rate: 4% / 12 (converted to monthly rate)

- Nper: 30 * 12 (converted to number of monthly payments)

- Pv: -200000 (negative value to represent a loan)

- Fv: 0 (assumes no future value)

- Type: 0 (assumes payments are made at the end of each period)

- Click "OK" to calculate the monthly payment of $954.88.

Advantages of Using Financial Functions

Using financial functions in Excel offers several advantages:

- Accuracy: Automated calculations minimize the risk of errors.

- Efficiency: Functions save time compared to manual calculations.

- Consistency: Functions ensure that calculations are performed using standardized methods.

- Customization: Functions can be combined and customized to create complex financial models.

Conclusion

Microsoft Excel’s financial functions are a powerful tool for financial analysis and management. These functions allow users to perform complex calculations quickly and accurately, saving time, reducing errors, and providing insights into financial data. By leveraging these functions, users can make informed decisions and improve their financial planning and management.