SMS Fraud for Bank Account Login: Security Alert

What is SMS Fraud?

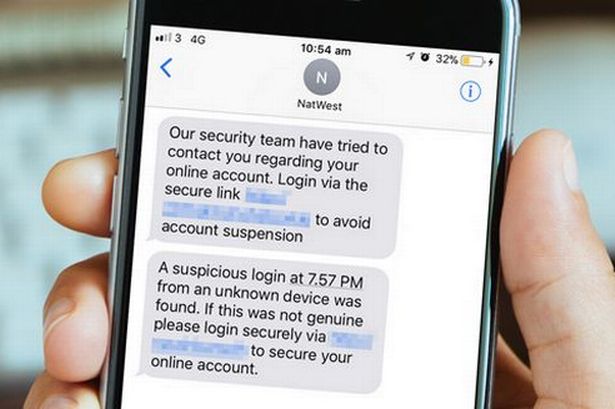

SMS fraud involves criminals sending text messages disguised as legitimate messages from banks or other trusted sources. These messages often contain links to malicious websites or request sensitive account information, such as login credentials or one-time passwords (OTPs).

How Does SMS Fraud Work?

Criminals may obtain your phone number from various sources, such as social media, data breaches, or phone directory listings. They then send fraudulent SMS messages that appear to be from your bank. These messages may:

- Claim suspicious activity and prompt you to click a link to update your password.

- Request OTPs to complete transactions or gain access to your account.

- Notify you of a prize or promotion that requires you to enter account details.

How to Protect Yourself:

To protect yourself from SMS fraud:

- Never click on suspicious links: Links in SMS messages can lead to malware or phishing websites that steal sensitive information.

- Verify with your bank: If you receive an SMS that appears to be from your bank, contact them directly through their official channels (e.g., phone, email, branch visit) to confirm the legitimacy of the message.

- Enable two-factor authentication (2FA): 2FA adds an extra layer of security by requiring a second form of verification, such as a physical token or a code sent to your email address, when logging into your bank account.

- Use strong passwords: Create complex passwords that are not easily guessable.

- Regularly monitor your bank account: Check your account statements for any unauthorized transactions.

What to Do if You Encounter SMS Fraud:

- Do not respond: Do not reply to or forward fraudulent messages.

- Report the fraud: Notify your bank immediately and report the incident to your mobile carrier.

- Change your passwords: Update your passwords for all affected accounts, including your bank account and any other accounts where you have used the same password.

- Enable fraud alerts: Set up fraud alerts with your bank to be notified of any suspicious activity on your account.

Remember: Banks will never ask you to provide sensitive account information via SMS. If you receive a suspicious SMS, it is crucial to report it and take proactive steps to protect yourself from fraud.